PPP Loan Update – April 22

The Paycheck Protection Program (PPP) ran out of money last week. Despite its bumpy start, the program had approved more than 1.5 million applications from distressed small businesses in less than two weeks. As a result of the funding shortfall, the Small Business Administration (SBA) ceased taking applications from lending institutions.

After negotiating all weekend, the White House and Democrats are reporting that they are near a deal. Dubbed Stimulus 3.5, the new round of funding includes another $300 billion for the PPP, $50 billion for disaster relief loans (Economic Injury Disaster Loans), $75 billion for hospitals and $25 billion for testing. It’s being predicted that the new bill will be approved as early as today. Given the dire straits many of the nation’s 30 million small business find themselves in, hopefully businesses will be approved shortly afterward. For the moment, some banks will continue to accept applications for when the pipeline opens again. Others may tell small business owners just to have their applications ready.

PPP loans are a much needed lifeline. They can be for 2.5 times payroll costs, up to $10 million, and feature a streamlined application process and fewer conditions. Most importantly, PPP loans can be forgiven, fully or in part, depending on if borrowers maintain head counts and payrolls at pre-pandemic levels and use their loan for authorized expenses.

If you were going to apply for a PPP loan, which the SBA classifies as a 7( a) loan, you should still get your paperwork ready. Read on to understand what is required, how much you can borrow, how forgiveness works and other key specifics. You should also research other business relief options.

Do You Qualify for a PPP Loan?

Almost any small business with 500 or fewer employees may be eligible. This includes small businesses, corporations, LLCs, private nonprofits, faith-based organizations, tribal groups and veteran groups. Self-employed individuals who file an IRS Schedule C with their Form 1040, such as independent contractors and sole proprietors, are also eligible. (Partners who report self-employment income, however, are not eligible as self-employed individuals.).

Restaurants and hospitality businesses may qualify if they have 500 or fewer employees per location. Details on the size standards and exceptions are on the SBA website.

Ineligible enterprises include those engaged in illegal activities, owners more than 60 days delinquent on child support obligations, farms and ranches, sex businesses, lobbyists and gambling establishments.

Terms of a PPP Loan

The government’s aims to aid businesses have resulted in reasonable terms for PPP loans. Borrowers can receive two and a half times their average monthly payroll costs (excluding compensation in excess of $100,000 per employee) incurred 12 months before the date the loan is made (some lenders are just using 2019 numbers). For example, if your monthly average payroll (excluding compensation in excess of $100,000 salaries) in the last 12 months is $10,000, you may borrow up to $25,000. Furthermore, you can include as payroll costs: payment for vacation, parental, family, medical and sick leave (that is not covered by another emergency loan/grant); payment for dismissal or separation; payment for group health care coverage, including insurance premiums; payment for retirement benefits and payment of state and local taxes assessed on employees’ compensation.

Also, you can add to your total loan amount the outstanding amount of any Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020, less any “advance” that is forgivable under an EIDL COVID-19 loan.

With most Americans under some form of lockdown and businesses across the country closed, PPP loans are a necessary lifeline. They can be for 2.5 times payroll costs, up to $10 million, and feature a streamlined application process and fewer requirements. Most significantly, PPP loans can be forgiven, fully or in part, depending on if borrowers maintain head counts and payrolls at pre-pandemic levels and use their loan for permitted expenses.

If you were planning on apply for a PPP loan, which the SBA categorizes as a 7( a) loan, you should still get your paperwork prepared. Read on to understand what is required, how much you can borrow (use our PPP calculator, below), how forgiveness works and other key details. You should also research other business relief options. If you’re feeling overwhelmed, you can contact a representative from G-Force Funding for assistance by phone (877) 406-4218 or email: [email protected]Â

PPP Loan Forgiveness

Small businesses will have their loans forgiven if they use the money for designated expenses. Participants are eligible for loan forgiveness for the amounts spent on authorized expenses over the eight weeks after the loan is disbursed.

The total payments for payroll over the eight weeks after the loan is disbursed may be forgiven. Mortgage interest, rent and utilities are also forgivable, up to 25% of the PPP loan.

To get the entire amount of the loan forgiven (assuming that at least 75% is spent on payroll and the rest on permitted expenses), you must meet two criteria. First, the full-time employee headcount can not decline from average monthly levels during 2019 or during the past 12 months. If your business started in the H2 of 2019, you can use average headcounts from January 1, 2020 to February 29, 2020. If you have a seasonal business, you can base your monthly averages on numbers from February 15, 2019, or March 1, 2019 to June 30, 2019.

Second, for loans to become full grants, employers can not cut salaries or wages. If they do, the forgiven amount will be reduced. Employers who already let workers go have until June 30 to restaff. The SBA has yet to issue guidance on how a smaller staff or payroll will reduce the amount eligible for forgiveness.

Another provision of the program allows borrowers who already have disaster assistance loans to defer payments through Dec. 31. This is an automatic deferment. Borrowers don’t have to do anything to qualify for it.

The SBA has a summary of loan terms here: https://home.treasury.gov/system/files/136/PPP–Fact-Sheet.pdfÂ

How to apply for a PPP loan

Banks, primarily community banks, began accepting PPP loan applications from small businesses and sole proprietorships on April 3. Independent contractors and self-employed individuals, including freelancers, could apply starting April 10. The program ends June 30, though borrowers are encouraged to apply as soon as possible. Note that many lenders are limiting eligibility to those businesses with whom they have a pre-existing relationship, such as previous loans or a business checking account.

You can apply immediately for the PPP Loan program with G-Force Funding here: www.gforcefunding.com/apply

Here is our current required document list:

- Completed SBA Paycheck Protection Program Application Form

- 2018 (or 2019) personal and biz tax return

- Last 6 months bank statements and MTD

- All owners’ Driver’s Licenses (front and back)

- IRS Form 940 and 941 (as of 12/31/19 and 3/31/20, respectively)

- Payroll Report for February 15, 2020 (or closest date).

- Annual Payroll Report for 2019 (calendar year through December 31, 2019)

- If an SBA EIDL loan was made between 1/31/2020 and 4/3/2020, a copy of the note

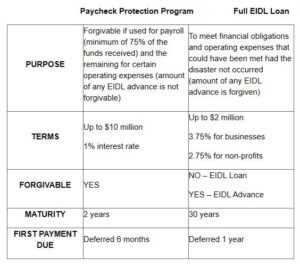

Here is a side by side comparison of the PPP loan & EIDL loan:

Content & Creative Writer | Blogger | Small Business Funding Advocate | Effective Communications | Entrepreneur |Traveler