A Quick Guide to Invoice Factoring for Your Business

Waiting on outstanding invoices to earn money has long been a huge pain for small businesses. It’s approximated that at least $3.1 trillion in receivables is owed to businesses in the U.S. right now. When companies pay late, the issue gets compounded. Access to capital is especially vital throughout the COVID-19 economic environment. This demand for quick cash has led many businesses to think about invoice factoring (offering receivables to an invoice factoring company at a discount rate, plus a cost).

Why companies use factoring

Receivables factoring is when a company purchases a debt or invoice from another company. In this purchase, accounts receivable are discounted in order to permit the purchaser to earn a profit upon the settlement of the debt. Basically factoring transfers the ownership of accounts to another party that then chases up the debt. Factoring for that reason relieves the first party of a financial obligation for less than the total amount providing them with working capital to continue trading, while the purchaser, or factor, chases up the debt for the total and profits when it is paid. The factor is required to pay additional costs, usually a small percentage, once the debt has actually been settled. The factor might also offer a discount to the indebted party.

Factoring has been a common B2B practice for more than 3,700 years. Basically, it’s a method for SME to obtain cash money earlier instead of having to wait for their clients to pay on net terms, pay past due, or otherwise in any way.

What is a Factoring Advance Rate?

A factoring advance rate is the percentage of the amount you receive when factoring the invoice. Advance rates generally vary from 80% to 90% of your invoice amount. Meaning, if you factor an invoice for $100,000, you typically are advanced $80,000( 80%) or $90,000( 90%).

Your factoring advance rate is the most important number when taking a look at factoring expenses, it’s even more important than the fees. Why? The reason you are factoring in the first place is to enhance your cash flow. The advance rate must be high enough to cover your cost of goods sold. Otherwise, the benefit of using factoring for your capital concerns would not be viable.

How do Factoring Costs Work?

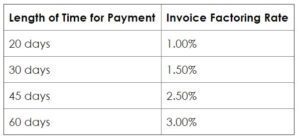

Bear in mind that a factoring fee is not an APR or interest rate. Often times business owners are confused and use interest rate formulas to factoring, however it simply does not work that way. A factoring fee resembles how your charge card may charge a monthly or daily set charge to have the account open. This resembles how a factoring fee works. It is a percentage of the invoice amount. A factor uses a percentage of the invoice quantity as their cost to you as low as 0.79-2.29% as much as 30 days.

If you are interested in applying for receivables factoring or would like to find out more about our factoring programs, please APPLY HERE

Content & Creative Writer | Blogger | Small Business Funding Advocate | Effective Communications | Entrepreneur |Traveler